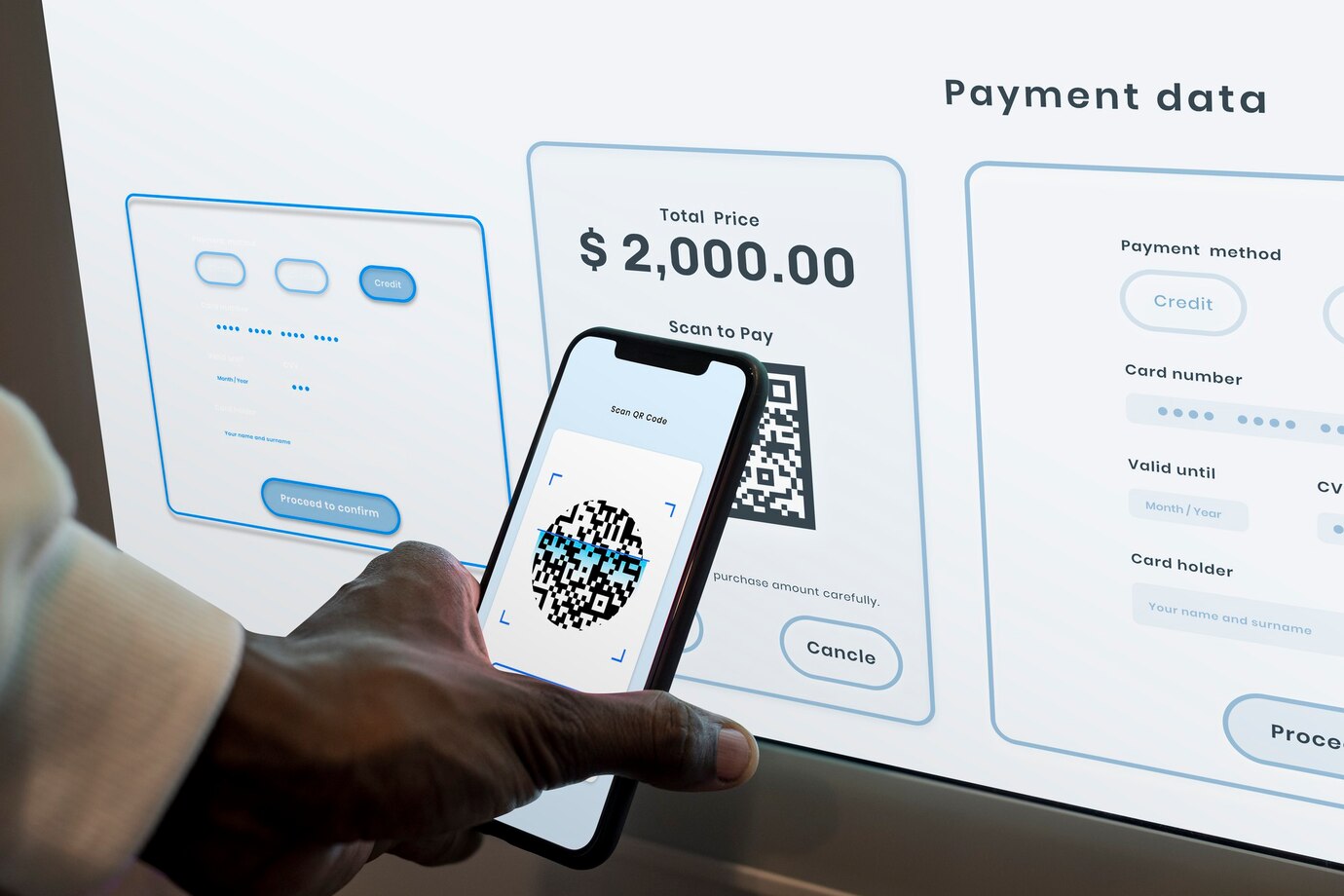

How to Integrate Payment Gateways into Your Mobile App

In the rapidly evolving landscape of mobile applications, payment gateways have become an essential component for businesses looking to offer seamless transactions to their users. For mobile app development , integrating payment gateways is not only a technical task but a strategic move that impacts user experience, trust, and ultimately revenue generation. This article will guide mobile app development through the intricacies of integrating payment gateways, ensuring a smooth and secure payment process.

Understanding Payment Gateways

Payment gateways act as the bridge between your mobile app and financial institutions. They securely handle payment data, facilitating transactions between customers and merchants. For mobile app development , choosing the right payment gateway is crucial as it directly affects the functionality and reliability of the app. Consider factors like transaction fees, supported payment methods, compatibility with platforms, and security features when selecting a payment gateway.

Choosing the Right Payment Gateway

The first step in integration is identifying a payment gateway that aligns with your app’s goals and target audience. Popular options include PayPal, Stripe, Square, and Razorpay, each offering unique features tailored to specific needs. For instance, if your audience is global, opt for gateways supporting multiple currencies. For apps targeting specific regions, prioritize local payment methods. Mobile app developers must also ensure the chosen gateway complies with legal and regulatory requirements in their target market.

Setting Up Your Payment Gateway Account

Speed is critical in the mobile app development industry, where time-to-market often determines success. React Native’s hot reloading feature allows developers to see changes in real time without restarting the entire application. This accelerates debugging and development processes, enabling quicker iterations and improvements.

Additionally, the pre-built components and libraries available within the React Native ecosystem allow developers to integrate features like navigation, animations, and API access effortlessly. These tools minimize the need for building functionalities from scratch, further reducing development time.

High-Performance Applications

Before diving into the technical aspects, you need to create an account with your chosen payment gateway provider. This typically involves registering your business, providing necessary documentation, and configuring settings like currency preferences and payout schedules. Mobile app developers should also familiarize themselves with the provider’s API documentation, which serves as the roadmap for integration.

Integrating Payment Gateway APIs

API integration is the backbone of payment gateway functionality in Mobile App. Most payment gateways offer SDKs (Software Development Kits) tailored for platforms like iOS and Android. As a mobile app developer, your task is to integrate these SDKs into your app seamlessly. Start by including the SDK in your project dependencies. Then, implement the required methods for initializing the payment process, handling transactions, and processing callbacks.

During integration, pay close attention to the UI/UX of the payment flow. Ensure the process is intuitive and aligns with your app’s design aesthetics. A poorly designed payment interface can lead to user frustration and increased cart abandonment rates.

Ensuring Security and Compliance

Security is a top priority when integrating payment gateways. Mobile app developers must adhere to the PCI DSS (Payment Card Industry Data Security Standard) guidelines to safeguard sensitive payment data. Implement SSL encryption to secure data transmission and avoid storing sensitive information on your servers unless absolutely necessary.

Additionally, enable features like tokenization and 3D Secure authentication to add extra layers of security. Regularly update your app and payment gateway SDK to mitigate vulnerabilities. Compliance with data protection laws such as GDPR or CCPA is also essential, particularly when handling users’ personal and financial information.

Testing the Integration

Before launching your app or rolling out the payment gateway feature, rigorous testing is essential. Use sandbox environments provided by payment gateway providers to simulate transactions without involving real money. Test various scenarios, including successful payments, declined transactions, and edge cases like network failures.

Mobile app developers should also test the payment flow on different devices, operating systems, and network conditions to ensure a consistent experience. Debugging errors at this stage is easier and more cost-effective than fixing issues post-launch.

Optimizing for Performance and User Experience

A fast and responsive payment process significantly enhances user satisfaction. Optimize API calls to reduce latency and ensure quick transaction processing. Mobile app developers should also focus on creating a frictionless experience by offering multiple payment options, such as credit/debit cards, digital wallets, and UPI.

Provide clear instructions and feedback during the payment process to guide users. For instance, display messages for successful transactions or errors in real-time. Additionally, consider implementing features like saved payment methods to streamline repeat purchases.

Monitoring and Maintenance

Integration doesn’t end at implementation; continuous monitoring and maintenance are crucial for sustained performance. Use analytics tools to track transaction success rates, user drop-offs, and payment-related issues. Mobile app developers should set up alerts for critical errors to address problems proactively.

Regularly review updates from your payment gateway provider and incorporate new features or security patches. Stay informed about changes in payment regulations to ensure ongoing compliance.

Conclusion

Integrating a payment gateway into your mobile app is a multifaceted process that demands attention to technical details, security measures, and user experience. For mobile app development , mastering this integration can set the stage for increased user trust and higher conversion rates. By following best practices and continuously optimizing the payment process, you can deliver a seamless and secure transaction experience, keeping your app competitive in the ever-growing mobile ecosystem.